Noah Rosenfarb

Key Principal

- 20+ years of real estate investment experience in fractional ownership of large assets to create multiple passive income streams

- 30+ acquisitions, 4,000+ apartment units currently, 2,000+ sold and over 500,000 sqft of office and retail space

- 3rd generation CPA with focus on tax code to reduce and eliminate taxes

- Primary financial advisor for over a dozen families with $20M+ net worth each

- Sold 8 companies, owns over a dozen, and continues to acquire business, websites, and real estate.

- Technical expert for high performing families

- Philanthropic endeavors with participation and financial support

- Resides in Parkland, Florida with his wife, Amanda, and two young children.

- Passionate about travel, has visited 62 countries on 5 continents.

Noah has been featured in

Eve Runciman, Esq.

Property Sourcing and Investor Relations

- Real Estate Development, Investments, Legal, and Technology focused career.

- Developed and successfully divested large single family home neighborhoods in South Florida

- Completed full cycle home investments on Miami waterfront and inland residential properties,

- Obtained a certificate from the University of California Berkeley’s Haas Executive Education Department on Blockchain: Technologies and Applications for Business.

- Obtained an IBM Initiative-Cognitive Class.ai online course- Blockchain Essentials Certificate.

- Holds a Juris Doctor degree from St. Thomas University School of Law.

- Holds a Bachelor’s degree in Legal Studies from the University of Maryland University College.

- Holds an active Real Estate salesperson license.

- Community involvement and membership in Guardian Ad Litem (GAL), United Nations, Member of the disaster relief committee of the American BAR association and Dade Legal Aid amongst others

Tim Meyers

Market Analysis, Underwriting, Capital Markets and Asset Management

- Initiated and delivered AECOM’s global back office reorganization resulting in over $50M reoccurring annual savings to the company

- Lead strategic finance initiatives for AECOM’s government contracting operating unit resulting in improve efficiency and profit growth

- Former Financial Planning & Analysis Manager for $4.8B operating unit

- Negotiated rent contracts with Housing and Urban Development for long term rents in Northern Virginia single family home portfolio

- Retired after 10-year strategic finance career with AECOM, a Fortune 150 multinational firm

- Initiated commercial real estate investments for AECOM

- Supported due diligence and valuation pro forma on $2B sale of AMENTUM (2020)

- Supported $6B acquisition of URS (2014) with debt strategy and firm integrations

- Born in California and holds Economics and Finance B.S. from James Madison University (JMU)

Units under management

Complexes under management

Years of Management Experience

Units in Florida

Complexes in Florida

Cushman & Wakefield is Stone Banyan Capital’s preferred property manager. C&W will perform property level management and ensure the properties are always optimized and efficient. C&W is the nation’s second largest residential management firm with a storied track record. In addition to property management, SBC will be able to leverage C&W’s industry knowledge as being one the nations premier commercial real estate brokerages. This level of knowledge creates strategic advantages for Stone Banyan Capital that translates directly to acquiring and operating the best real estate for our investors.

Cushman & Wakefield’s property management teams make an impact for us with a holistic approach to management that drives real estate value and performance. C&W’s integrated teams of property managers, engineers and client accountants collaborate to minimize operating costs, foster strong tenant relationships and create engaging workplace experiences. C&W leverages its experience, investor suite of services and industry-leading research and insights to deliver the best property management and value to SBC.

Preferred Lender

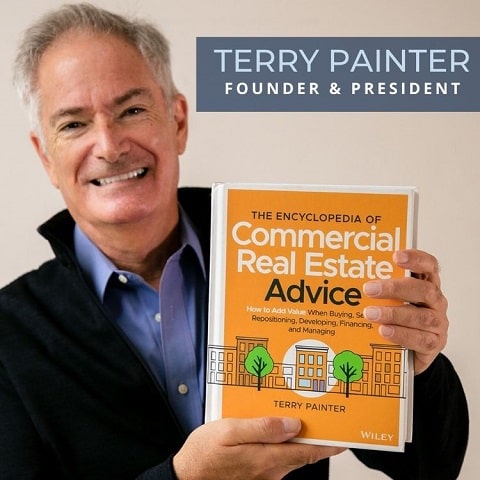

Terry Painter

In loans

Units

Complexes

Years of Terry’s CRE Experience

Years of Apartment Loan Store Experience

Terry is the founder of Apartment Loan Store and Business Loan Store. Apartment Loan Store is one of the nation’s largest multifamily capital providers. As commercial mortgage bankers and commercial mortgage brokers since 1997, his objective is to offer flexible financing solutions with the lowest risks from his platform of over 40 affiliated funding sources. These include:

- HUD/FHA

- Fannie Mae

- Freddie Mac

- CMBS

- Life Company Funds

- Private Debt Funds

- REITs

- Hedge Funds

- Secondary Market Wholesalers

- Large National Banks

- Regional Banks

- Terry's team are members of the National Mortgage Bankers Association, the Oregon Bankers Association and Forbes Real Estate Council.

- Terry has been a top producer for Lasalle Bank and Lehman Brothers and is known for his real estate investment consultations. For 18 years, Terry has spoken nationally to commercial real estate investor groups, real estate brokers, and banks about commercial real estate Investing and lending.

- Author of The Encyclopedia of Commercial Real Estate Advice published by Wiley

Featured in

Affiliates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

15%

Property Count

350

Unit Counts

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

15%

Property Count

350

Unit Counts

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

15%

Property Count

350

Unit Counts