The share of loan balances becoming newly delinquent was the lowest since the onset of the pandemic.

By Ted Knutson from GlobeSt.com | January 27, 2022 at 06:48 AM

Delinquency rates for mortgages backed by commercial and multifamily properties declined during the fourth quarter of 2021, according to the new Mortgage Bankers Association’s latest CREF Loan Performance Survey.

“The share of outstanding balances that are delinquent fell for both lodging and retail properties, as property owners and lenders and servicers continue to work through troubled deals. The share of loan balances becoming newly delinquent was the lowest since the onset of the pandemic,” said Jamie Woodwell, MBA’s Vice President of Commercial Real Estate Research in the announcement of the results.

He noted it is encouraging that particularly there was improvement among property types that were the most impacted by the downturn.

The improvements in the delinquency rates were small as 97.0% of outstanding loan balances for commercial and multifamily mortgages were current at the end of the fourth quarter, up from 96.7% at the end of the third quarter of 2021 while 1.9% were 90+ days delinquent or in REO, down from 2.2% three months earlier and 0.2% were 60-90 days delinquent, unchanged from three months earlier.

The sectors in the survey which have seen the biggest stress, lodging and retail properties, saw improvements during the period along with commercial and multifamily mortgages, as a whole.

MBA reported 10.5% of the balance of lodging loans were delinquent by the conclusion of December, down from 14.0% at the end of the third quarter of 2021 as the end of the fourth quarter saw 7.6% of the balance of retail loan balances were delinquent, down from 8.2% three months earlier.

CMBS loan delinquency rates are higher than other capital sources because of the concentration of hotel and retail loans, but they saw improvement during the final three months of 2021 as well.

According to MBA, 5.7% of CMBS loan balances were non-current, a fall off from 7.2% in last year’s third quarter.

Commentary by Tim Meyers

Most multifamily investors desire cash returns, but typically, their main motivation is the preservation of capital or put another way, the preservation of their purchasing power. This is one of main reasons multifamily apartments make such good retirement approaches. A good measure on a particular capital placement is to look at the rate of delinquencies in that area. There is close correlation between high delinquency and risk. Thus, to see what the risk profile of apartments is looks like, we can look at the delinquency rates as a good proxy.

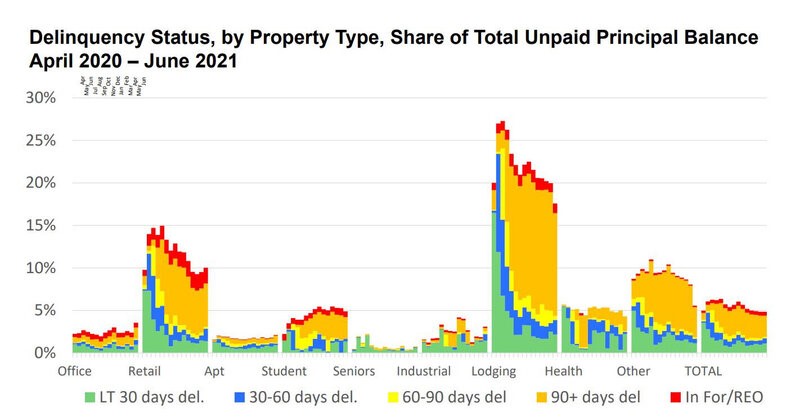

Mortgage Bankers Association’s (MBA) July 2021 CREF Loan Performance Survey

A main takeaway is that the delinquency rates for apartments during the pandemic was and still is quite low, in the 2-3% range. This low rate has been consistent throughout the pandemic. Other commercial industries haven’t faired so well, we could consider those industries as higher risk as a result.

Why did apartments do so well?

Many of the reasons that have kept apartments in good standing over the course of history presented themselves well over the past couple of years. Below are few benefits of apartments that other industries do not necessarily have that supported them well.

- Diversification of revenue

- Fundamental Need (Essential)

- Most Cost-efficient Shelter Option

Inflation hedged as apartments are their main cash outflow (long term debt) is fixed