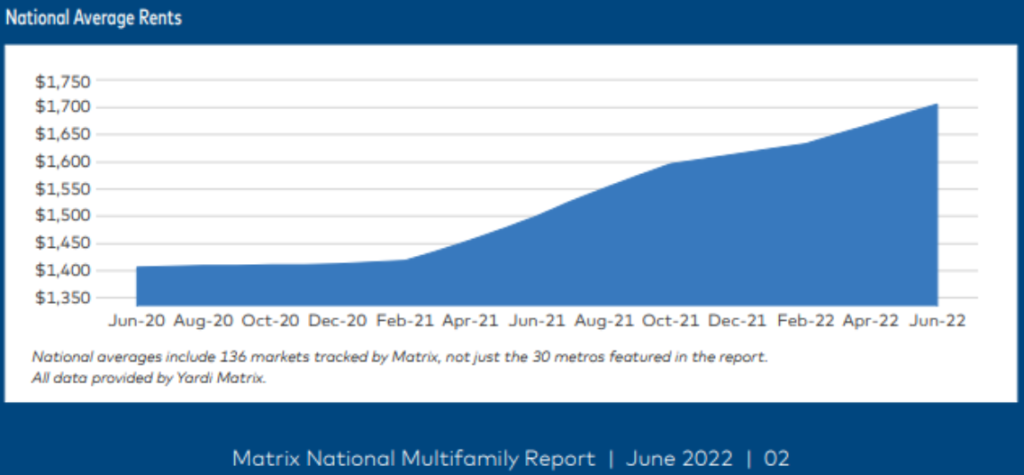

Multifamily performance continued strong as U.S. asking rents rose $19 for the month of June to an all-time high of $1,706, according to the Yardi Matrix June Multifamily Report.

“Robust household formation is driving demand, as people who lived with family or friends during the pandemic have formed independent households.

“However, absorption is slowing, presaging a second-half deceleration,” the Yardi Matrix report says.

Some highlights of the report:

- Multifamily performance remained strong in June despite economic deceleration in some other markets. Year-over-year growth decelerated by 50 basis points to 13.7 percent. That’s 130 basis points off the February peak of 15.2 percent, but still exceptional performance.

- Demand and rent growth remained strong throughout the country. Rent growth increased at least 10 percent year-over-year in 25 of Yardi’s top 30 metros. National occupancy rates were 96 percent.

- The single-family sector continues to grow on par with multifamily as homeownership becomes out of reach for more households. The average single-family asking rent increased by $23 in June to an all-time high of $2,071, as year-over-year growth dropped by 90 basis points to 11.8 percent.

A strong labor market will continue to allow rents to rise, but at a slower rate as the economy begins to cool down, the report says.

“Inflation and increasing interest rates have started to cool down the for-sale market, keeping more households in multifamily and single-family rental markets. However, inflation rates will take a while to ebb, causing consumers to cut into savings as their ability to afford increasing rental rates lessens,” Yardi Matrix says.

Occupancy Rates Point to Shift in Migration Patterns

Demand is continuing to cool in Sun Belt and Western metros, which could presage a deceleration in rent growth in coming months.

Occupancy rates year-over-year decreased in 11 metros in May, led by Las Vegas (-1.6 percentage points), Phoenix (-1.1) and Sacramento (-1.0), a likely sign that in-migration is weakening.

U.S. households have grown increasingly less mobile in recent decades, a trend that continued post-pandemic, per the Census Bureau.

Yardi Matrix says, “Freddie Mac noted in a recent paper that after years of outsize population growth, metros such as Denver, Nashville and Austin have begun to lose residents as housing costs soar. Notes Freddie: ‘The pandemic amplified existing urban de-concentration by threefold from large, expensive metro areas to smaller, more affordable destinations. Data also shows that in fast-growing metro areas, the continued shortage of housing and high house-price-to-income ratios eventually lead to increased out-migration as homebuyers seek more affordable destinations.’ ”

Credits: John Triplett, Rental Housing Journal