By: Ted Dabrowski and John Klingner from Wirepoints

Illinois, New York and California continued their streak as the nation’s biggest losers of residents and their wealth to other states, according to a Wirepoints analysis of newly-released Internal Revenue Service migration data.

Texas and Florida continued to be the nation’s big winners.

The latest IRS state-by-state migration data is based on tax returns filed in 2020 and 2021, covering taxpayers (tax filers and their dependents) who moved from one state to another between 2019 and 2020 (see appendix for changes in our reporting methodology).

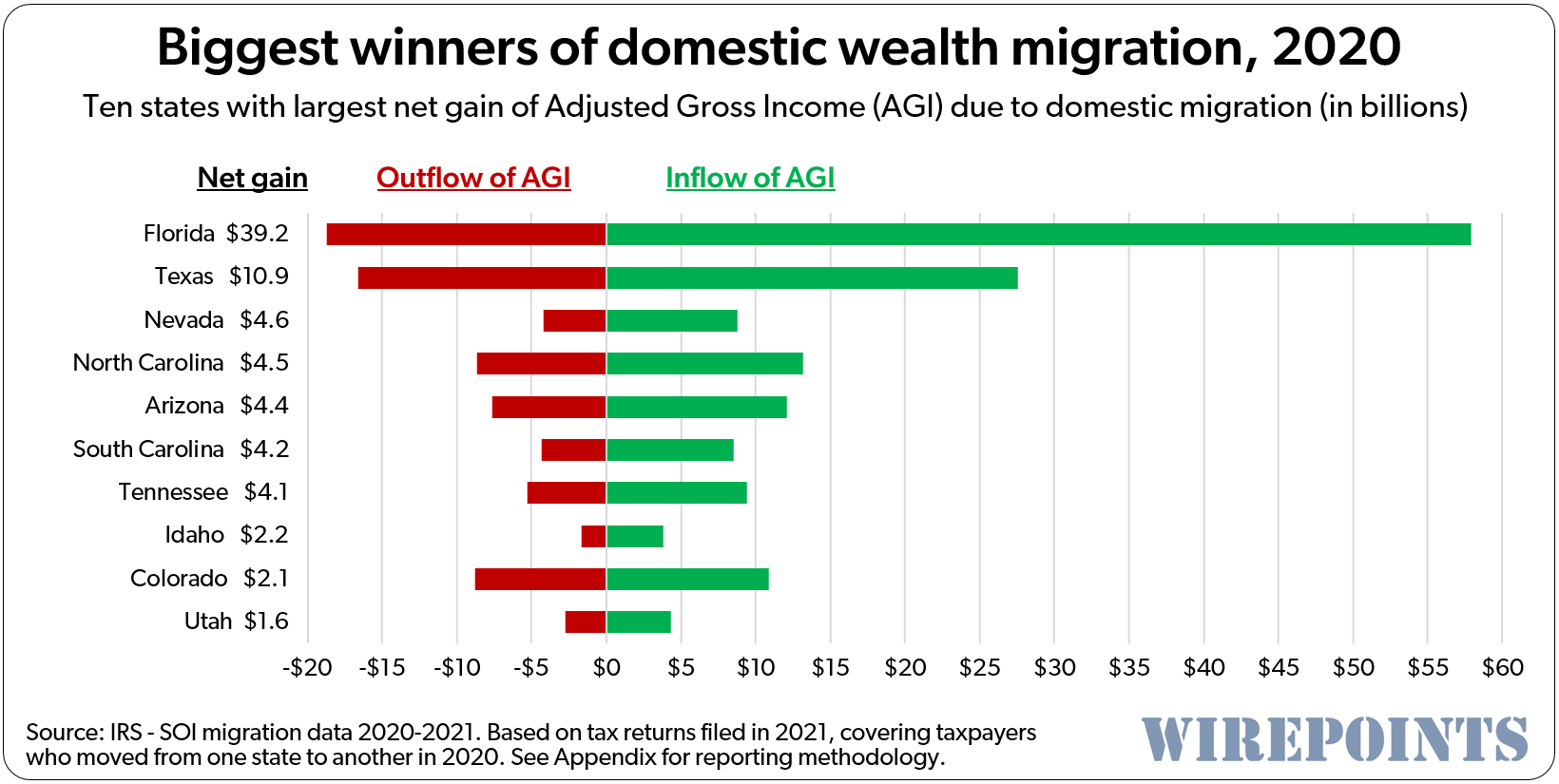

Florida, the nation’s perennial winner, gained in 2020 the most net people, 256,000, and the most net Adjusted Gross Income (AGI), $39 billion. Texas followed with a gain of 175,000 people and $10.9 billion in AGI.

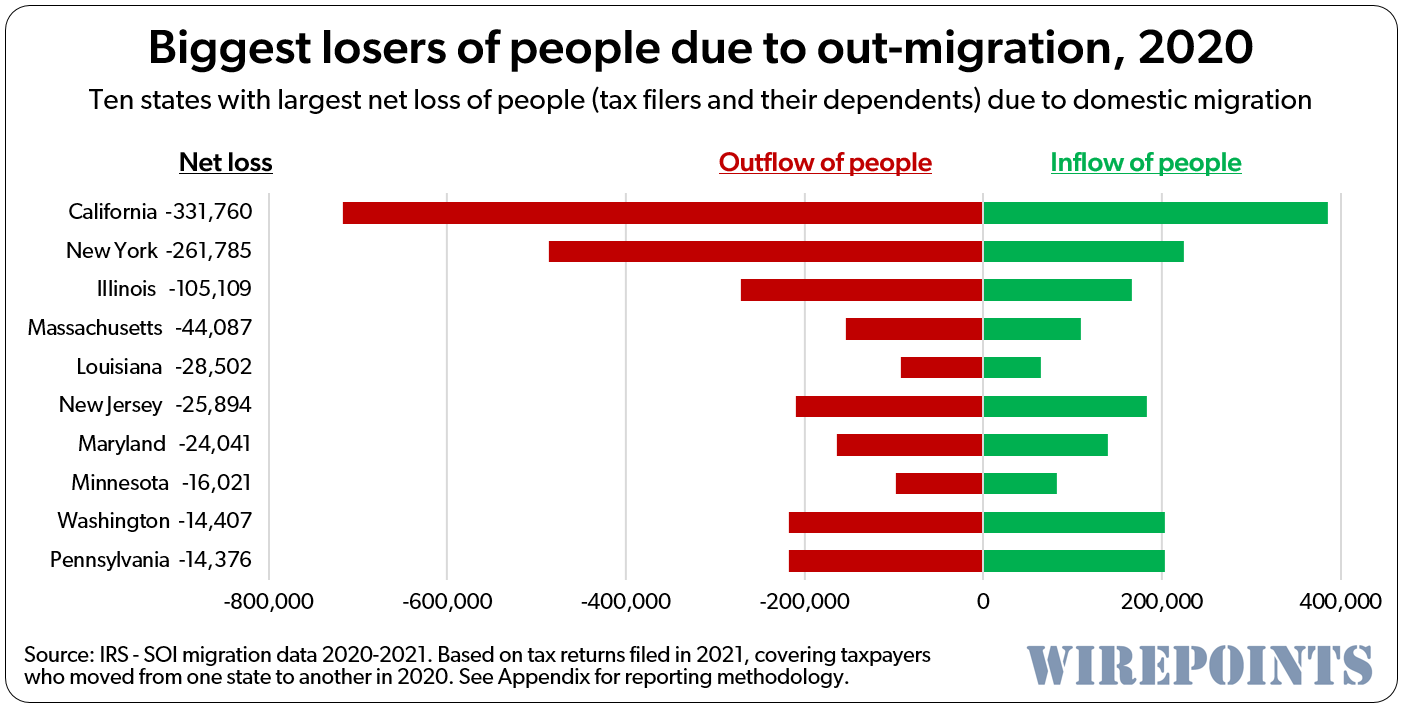

In contrast, states like California, New York and Illinois once again experienced some of the nation’s biggest losses. California lost more people than any other state, with more than 332,000 net movers taking $29 billion to other states.

Wirepoints’ accompanying Illinois analysis includes a long-term look at out-migration from the state.

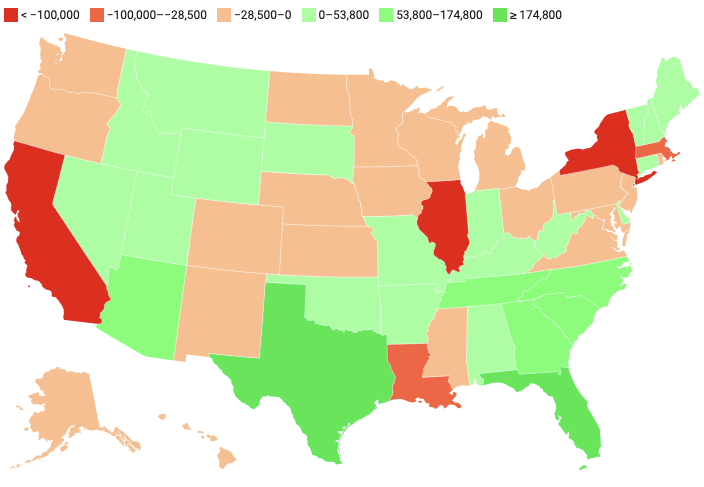

IRS data: States that won and lost the competition for people and their wealth in 2020

Ranked by net people (tax filers and dependents) gained/lost

The IRS migration report provides hard, indisputable data on the movement of Americans between states. The agency reviews tax returns annually to track when and where tax filers and their dependents move. It also aggregates the ages, income brackets and adjusted gross incomes of filers.

Winners and losers

The Sunshine State attracted over $57.9 billion in Adjusted Gross Income (AGI) from 699,000 new residents (tax filers and their dependents) that moved into Florida in 2020. On the flip side, Florida lost $18.7 billion in AGI from 443,000 people who left. On a net basis, Florida came out ahead with 256,000 net new people and $39.2 billion in net new taxable income.

That was a total gain of 3.1 percent of the state’s total AGI ($711 billion).

Texas was the runner up with an AGI income gain of $10.9 billion, followed by Nevada with $4.6 billion. North Carolina and Arizona rounded out the top five with net gains of $4.5 billion and $4.4 billion, respectively. (See Appendix for top 10 winners of people.)

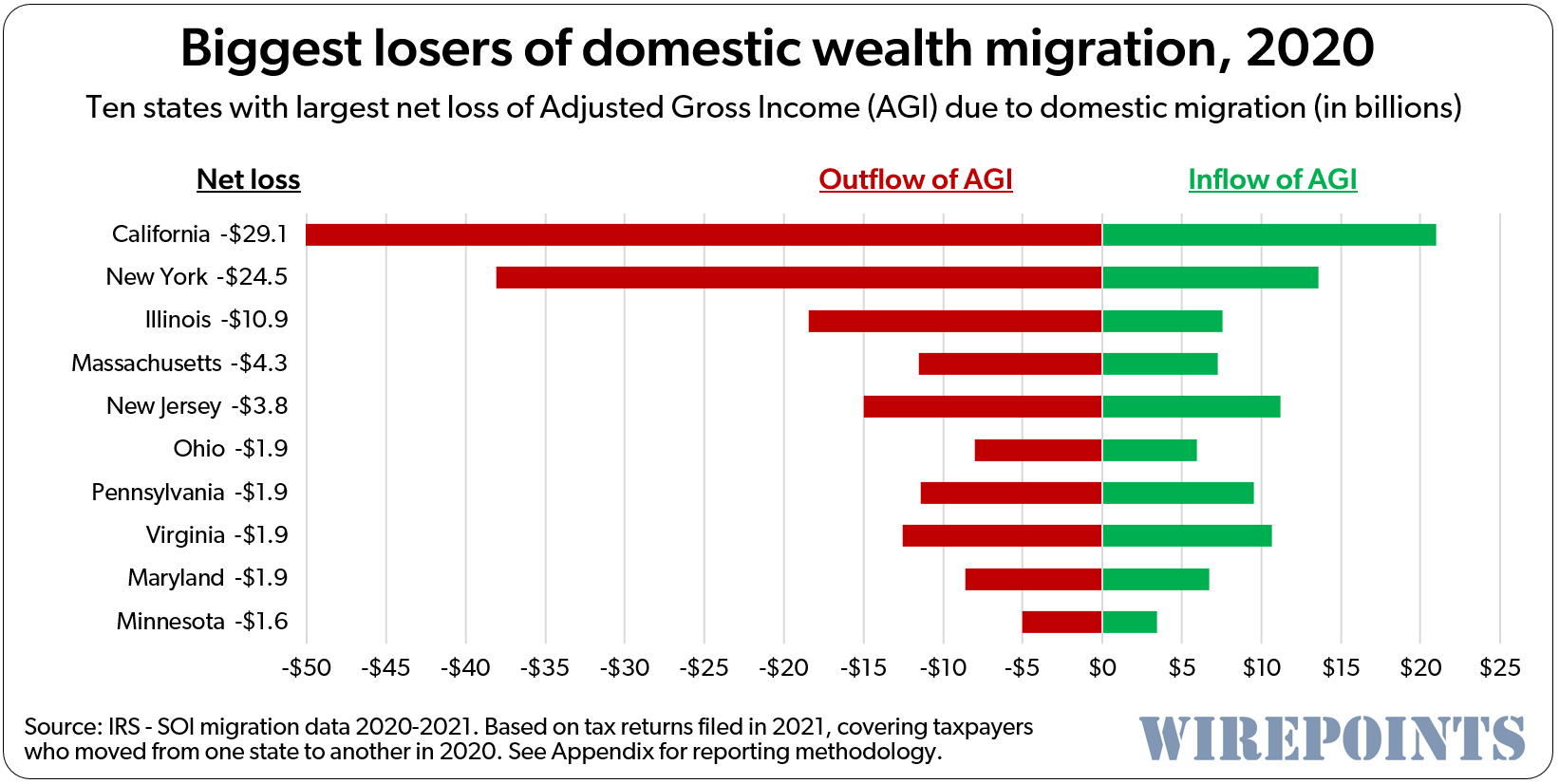

On the losing side, California suffered the worst outflow of money of any state in 2020. The Golden state lost a net $29.1 billion in income, or 2.0 percent of its AGI, while a net of 332,000 residents moved out.

On the losing side, California suffered the worst outflow of money of any state in 2020. The Golden state lost a net $29.1 billion in income, or 2.0 percent of its AGI, while a net of 332,000 residents moved out.

New York was next, losing a net $24.5 billion and 262,000 people. Illinois was 3rd with a net loss of $10.9 billion and 105,000 people. Massachusetts and New Jersey were in 4th and 5th place, with $4.3 and $3.8 billion in income losses, respectively. (See Appendix for top 10 losers of people.)

Tables with each state’s ranking in migration gains/losses are provided below.

Tables with each state’s ranking in migration gains/losses are provided below.

The cumulative impact of income losses and gains

The problem with chronic outflows, like in the case of New York, is that one year’s losses don’t only affect the tax base the year they leave, but they also hurt all subsequent years. The losses pile up on top of each other, year after year. And when a state loses income to other states for 21 straight years, the numbers add up.

In 2020 alone, New York would have had nearly $144 billion more in AGI to tax had it not been for the state’s string of yearly migration losses. And when the state’s AGI losses are accumulated from 2000 to 2020, it totals $1.1 trillion in cumulative lost income that could have been taxed over the entire period.

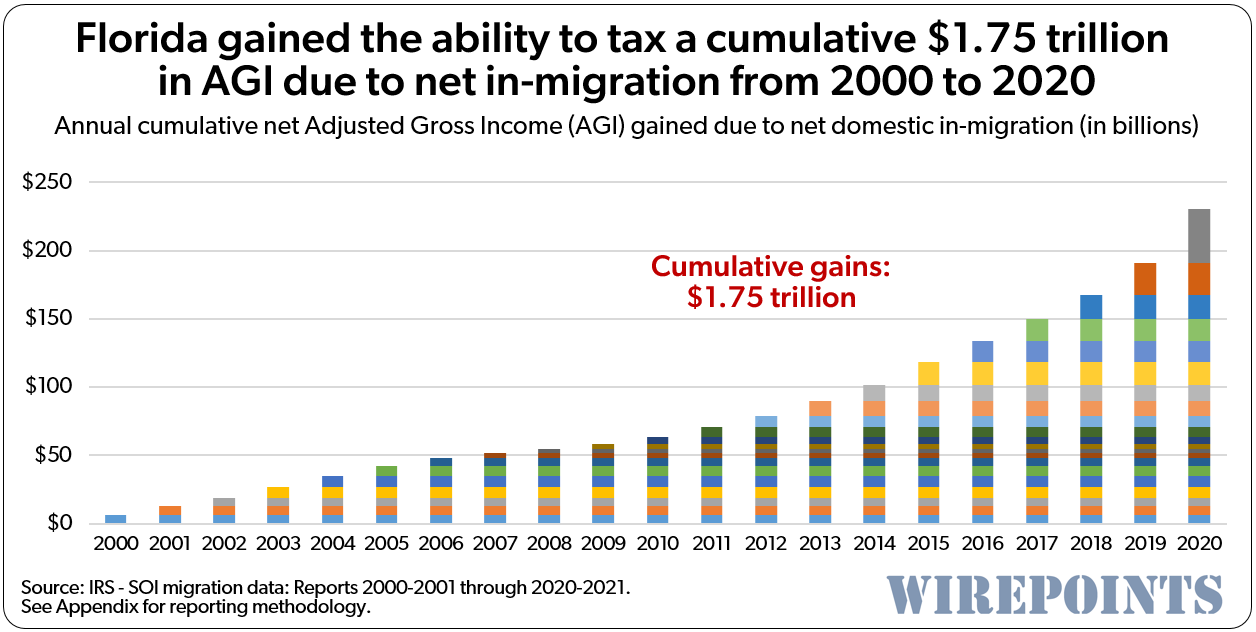

The opposite is true for migration winners like Florida. Gains in people and income pile on top of each other each year, building an ever-growing tax base. In 2020 alone, the state’s tax base was some $230 billion higher due to the 21-year string of positive income gains from net in-migration.

The opposite is true for migration winners like Florida. Gains in people and income pile on top of each other each year, building an ever-growing tax base. In 2020 alone, the state’s tax base was some $230 billion higher due to the 21-year string of positive income gains from net in-migration.

Even though Florida doesn’t tax incomes, Wirepoints also added up Florida’s cumulative AGI to make an apples-to-apples comparison with New York. When the Sunshine State’s AGI gains are accumulated from 2000 to 2020, it totals $1.75 trillion in income that could have been taxed over the entire period.

The competition for people matters

The competition for people matters

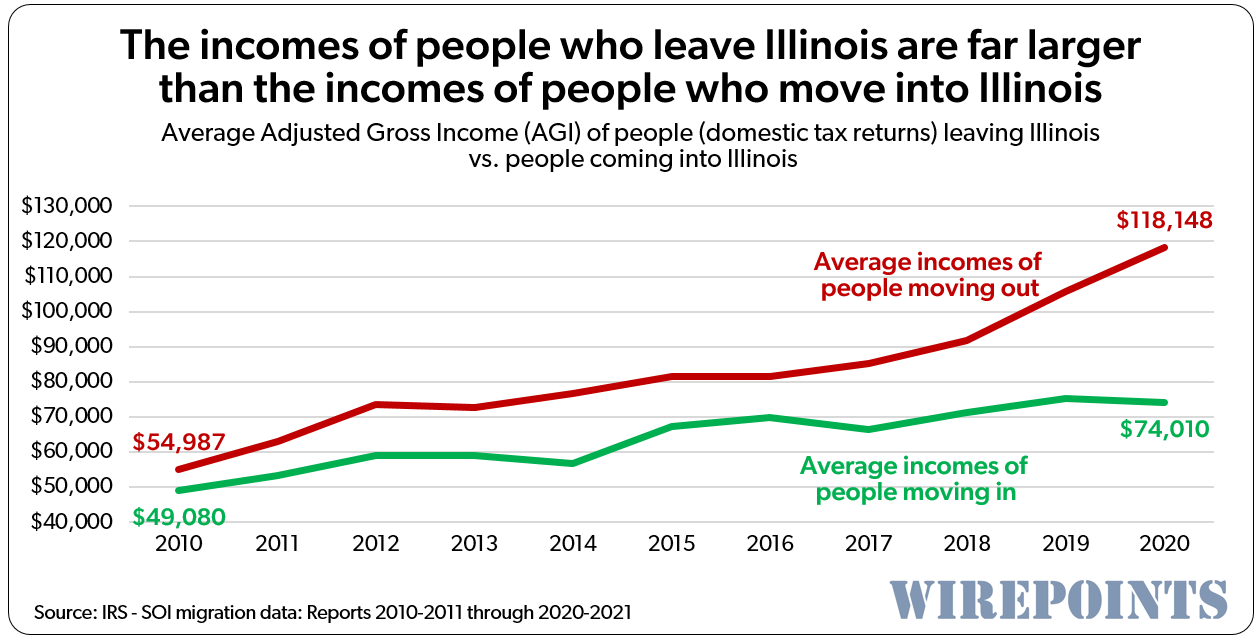

Illinois, one of the nation’s other big losers, shows just how damaging being an “exit” state can be – especially when a state starts to lose its wealthier residents and they are only partially replaced by people who make less. The Illinoisans who fled in 2020 earned, on average, $44,000 more than the residents Illinois gained from other states. That’s the biggest gap since at least 2000, based on Wirepoints’ analysis of the IRS data.

Based on a percentage of total income, Illinois ranked 2nd-worst nationally for income losses in 2020. Illinois lost 2.5 percent of its AGI. Only New York was worse, with a loss of 3.1 percent.

Based on a percentage of total income, Illinois ranked 2nd-worst nationally for income losses in 2020. Illinois lost 2.5 percent of its AGI. Only New York was worse, with a loss of 3.1 percent.

In contrast, Florida was the nation’s big winner on a percentage basis in 2020, gaining 5.5 percent of its AGI base. The nation’s top five were rounded out by Nevada, Idaho, Montana and South Carolina.

In contrast, Florida was the nation’s big winner on a percentage basis in 2020, gaining 5.5 percent of its AGI base. The nation’s top five were rounded out by Nevada, Idaho, Montana and South Carolina.

******************

The IRS data shows for yet another year Americans chose better managed, less expensive areas over larger, government-centric, high-cost cities and states. And it provides a glimpse of a demographic future in which states that prioritize an affordable, less intrusive government will dominate those that over-tax and over-regulate the lives and businesses of their residents.

Appendix

For years Wirepoints and others have reported the “taxpayer migration” year based on the IRS migration report date. Take, for example, last year’s “Migration Data 2019-2020” IRS report which is based on tax filings made in 2020. Most reports cited the migration data as 2020, which matches the IRS nomenclature.

However, the IRS explained in an email to Wirepoints that: “The 2019-2020 Migration Data refers to tax returns that were submitted to the IRS in calendar years 2019 and 2020, which corresponds to tax returns and income that was earned in 2018 and 2019, respectively.”

That means the true outmigration year in the example above is 2019, and not 2020.

Wirepoints has adjusted its ‘migration year’ in this year’s report to more properly reflect this fact.